stock option sale tax calculator

Before Tax Price Sales Tax Rate. Depending on your holding period of the stock the capital gain or loss is.

Understanding How The Stock Options Tax Works Smartasset

The following table shows an example of how much stock option values would be at various growth levels for an employee who annually obtained 1000 stock option grants at a strike.

. Non-qualified Stock Option Inputs. The amount you received for writing the option increases the amount received from the sale of the stock. Using this calculator is quite easy you are required to enter the following.

Section 1256 options are always taxed as follows. The spread the difference between the. The tax rate on long-term capital gains is much lower than the tax rate on ordinary.

And a commission cap at 10leg. Lets get started today. This calculator lets you estimate how much it will cost you to exercise your options or will help you compute the gain in a given exercise and sale scenario.

Click to follow the link and save it to your Favorites so. Ad Customizable options contract that cross margin the same underlying stock or index. This is an online and usually free calculator.

Stock option exit calculator See how much your stock could be worth See how much you might potentially bring home if your company IPOs or exits. Options profit calculator Options Profit Calculator provides a unique way to view the returns and profitloss of stock options strategies. Please enter your option information below to see your potential savings.

Answer Your basis in the stock depends on the type of plan that granted your stock option. Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP. Check out our free Capital Gains Interactive Calculator that in just one screen will answer your burning questions about your stock sales and give you an estimate of how much.

The Stock Option Plan specifies the employees or class of employees eligible to receive options. Ad Fidelity Has the Tools Education Experience To Enhance Your Business. Ad Were all about helping you get more from your money.

Calculate your potential gains after taxes. Option Exercise Calculator This calculator illustrates the tax benefits of exercising your stock options before IPO. Once youve opened it you need to provide the initial value at which the asset was bought the sale value at which you have sold it and the duration.

How to Calculate Sales Tax. Your Equity Administration Deserves Industry-Leading Strategies from Fidelity. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

Ad Fidelity Has the Tools Education Experience To Enhance Your Business. To arrive at your potential take-home gains youll need to subtract your costs from the resulting gain in the stocks value. If you exercise a non-statutory option for IBM at 150share and the current market value is 160share youll pay tax on the 10share difference 160 - 150 10.

Your Equity Administration Deserves Industry-Leading Strategies from Fidelity. Spend less time on tax compliance with an Avalara AvaTax plug in for your shopping cart. If you sell the stock when the stock price is 10 your theoretical gain is 9 per sharethe 10 stock price minus your 1 strike price.

On this page is an Incentive Stock Options or ISO calculator. Get started Know your options. This permalink creates a unique url for this online calculator with your saved information.

To help such investors we have designed this stock profitloss calculator that gives you accurate results in seconds. So in this example youd pay taxes on the 40 in. If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal.

Regarding how to how to calculate cost basis for stock sale you calculate cost basis using the. Cost basis 100 10 shares 10 each 10 purchase and sale fees 5 each 110Profits 150-110 40. To start select an options trading strategy.

You generally treat this amount as a capital gain or loss. Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account. You have taxable income or deductible loss when you sell the stock you bought by exercising the option.

Before-tax price sale tax rate and final or after-tax price. Multiply the price of your item or service by the tax rate. Ad Calculate sales tax automatically with an Avalara plugin for the ecommerce system you use.

The Stock Calculator is very simple to use. How much are your stock options worth. The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

Ad tastyworks is built for speed with features for the active trader. The Stock Option Plan specifies the total number of shares in the option pool. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your.

Just 1option to open 0 to close.

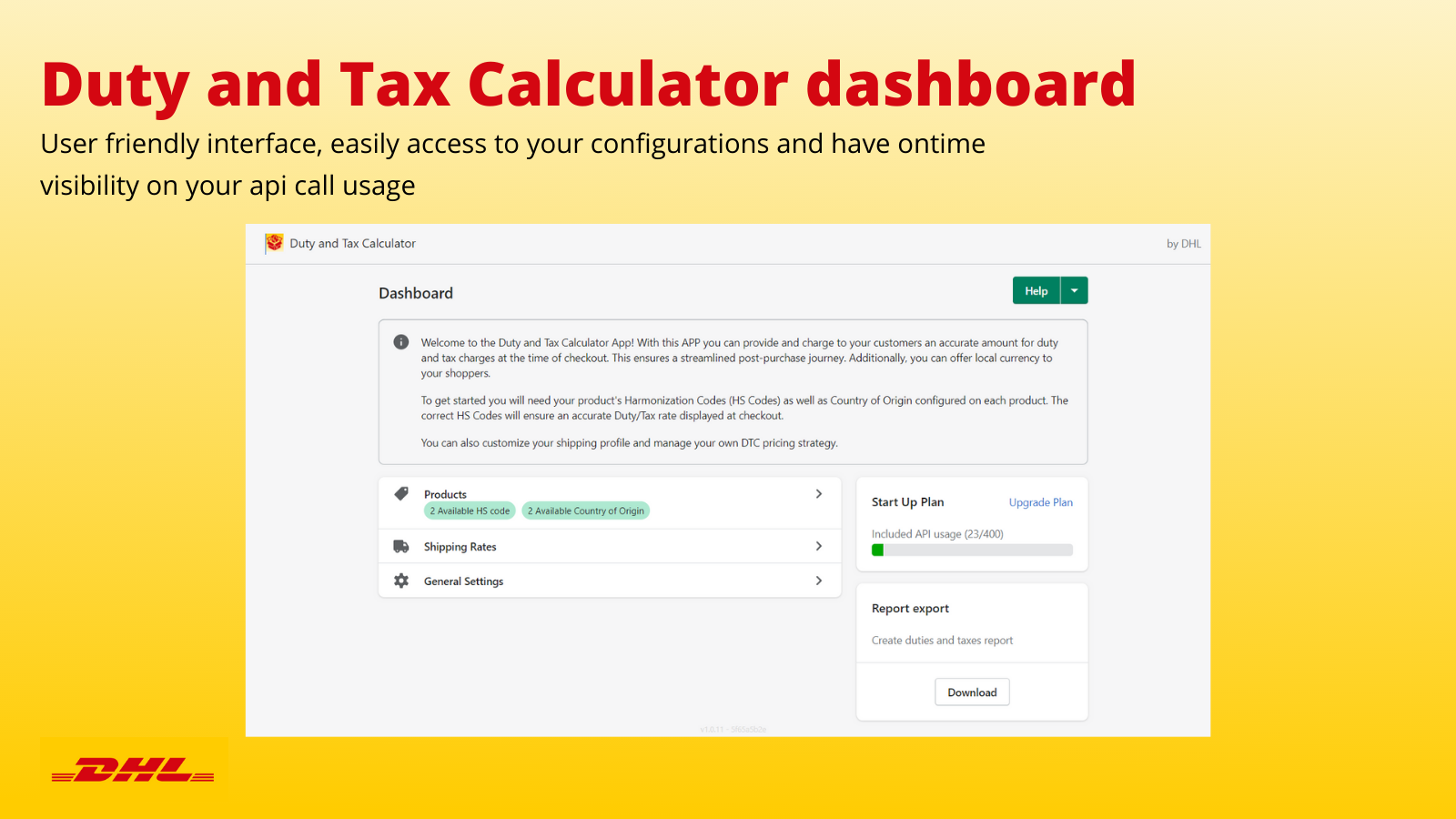

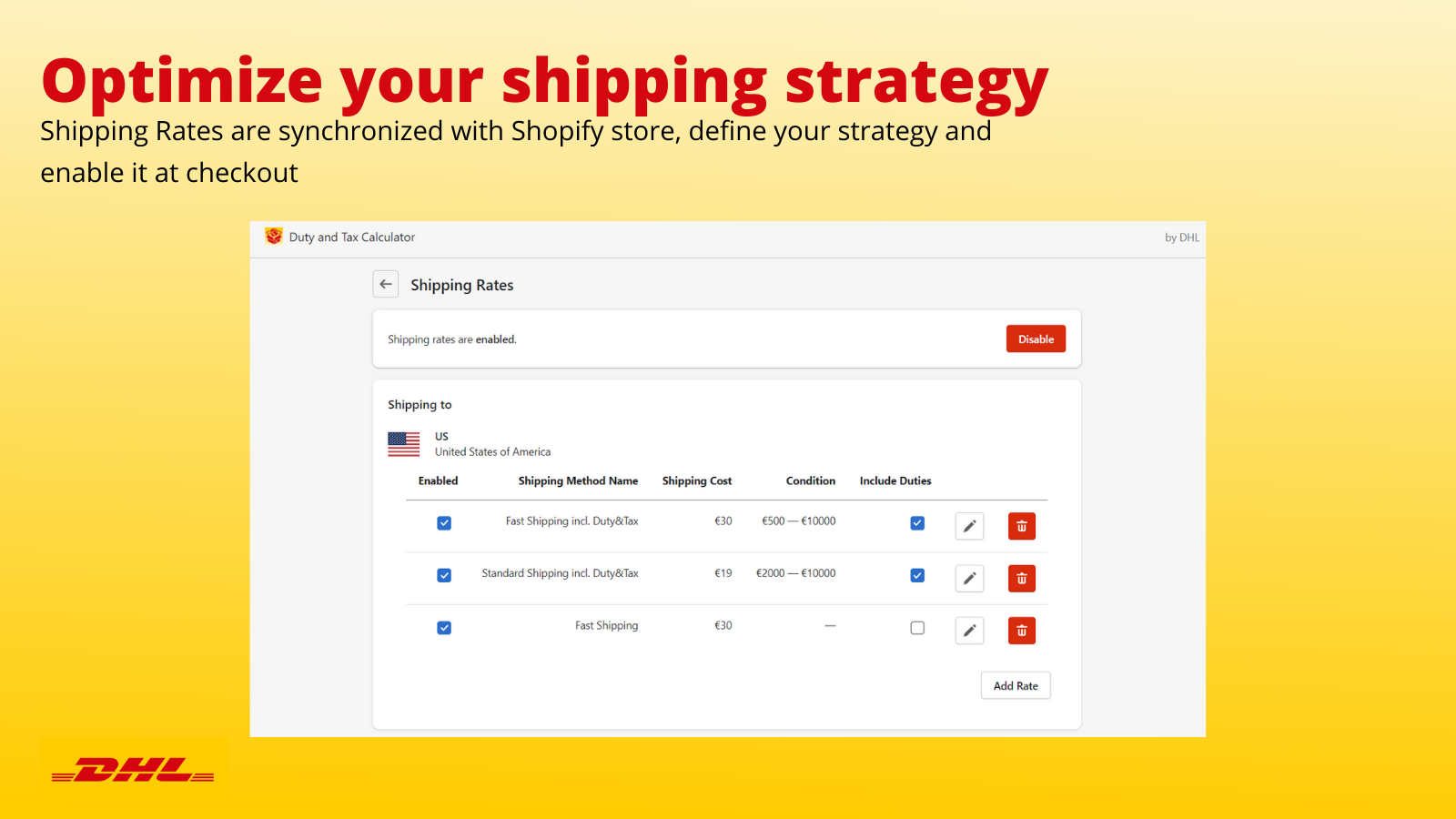

Duty And Tax Calculator Simplify Your Business With Duties And Taxes At Checkout Shopify App Store

Rsu Taxes Explained 4 Tax Strategies For 2022

Pro Tips 4 Tax Return Errors To Avoid With Stock Options Rsus And Stock Sales

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

How To Calculate Cannabis Taxes At Your Dispensary

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

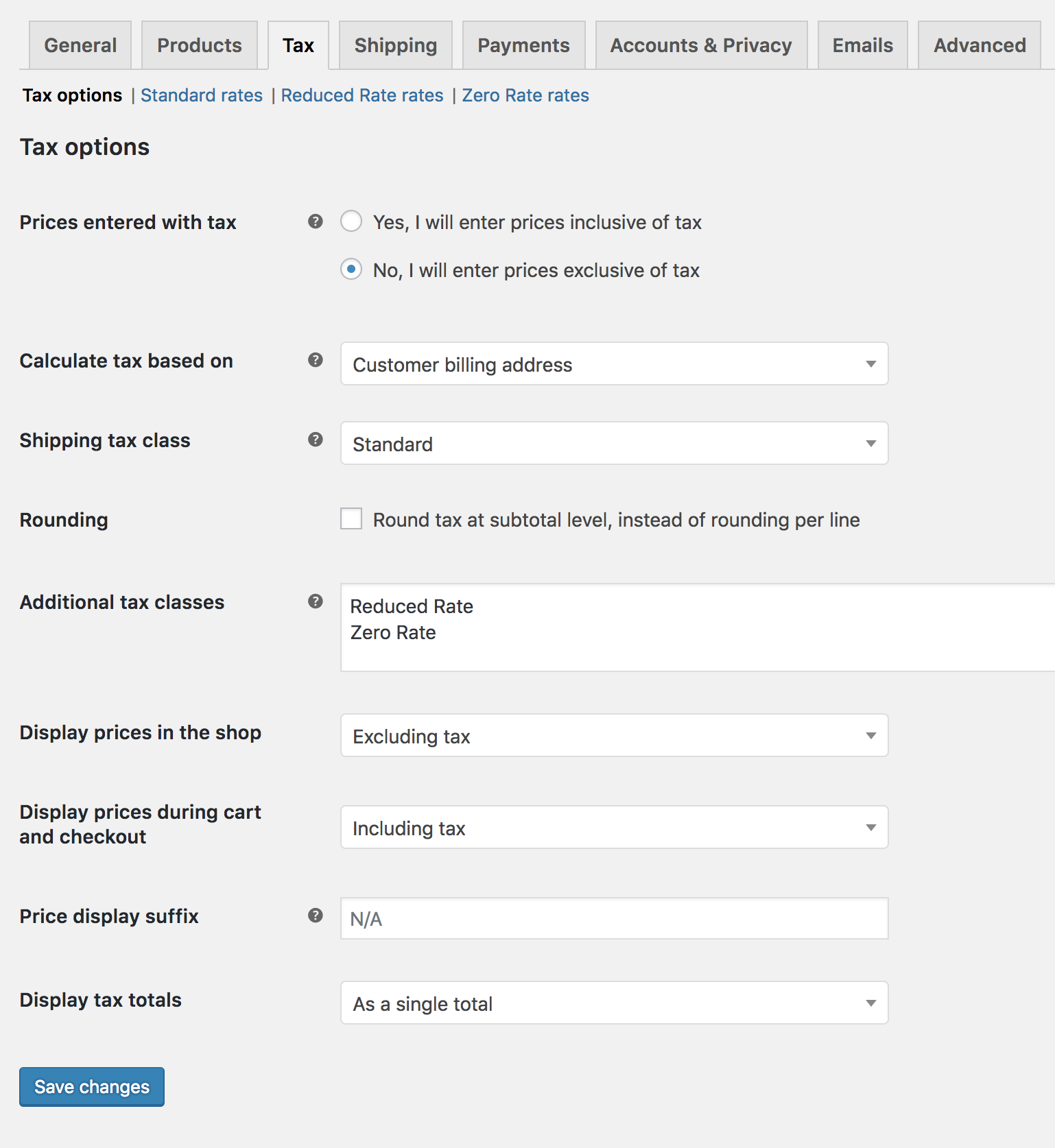

Setting Up Taxes In Woocommerce Woocommerce

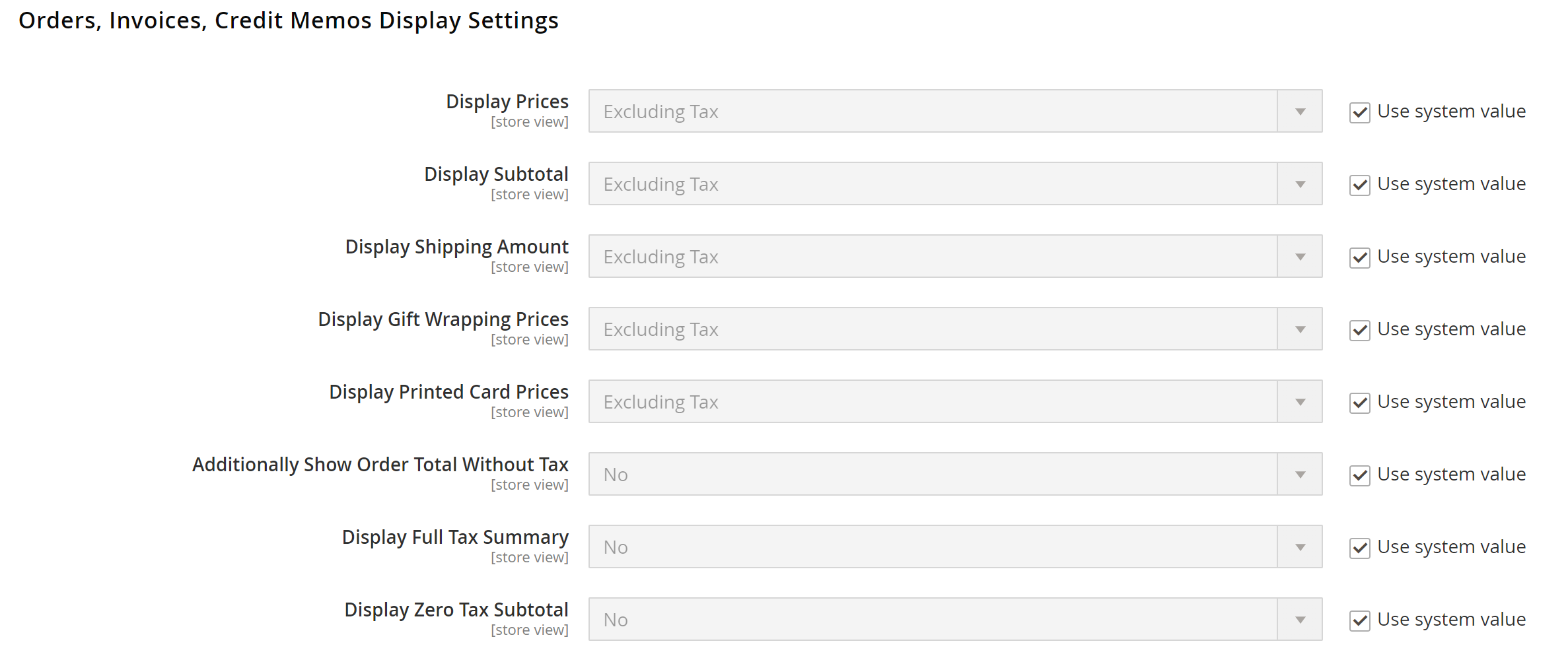

General Tax Settings Adobe Commerce 2 4 User Guide

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-03-4346254c24b54206b3dda8692d4f0f7c.jpg)

Employee Stock Option Eso Definition

How Stock Options Are Taxed Carta

Rsu Taxes Explained 4 Tax Strategies For 2022

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Capital Gains Tax Calculator The Turbotax Blog

Woocommerce Sales Tax In The Us How To Automate Calculations

How Stock Options Are Taxed Carta

/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-270d01a202284fcc98be049a8cdbbb40.jpg)

Employee Stock Option Eso Definition

Duty And Tax Calculator Simplify Your Business With Duties And Taxes At Checkout Shopify App Store